W-9 form and ACH/Wire transfers

This article provides information about the W-9 form and the process of payment via ACH or Wire transfer.

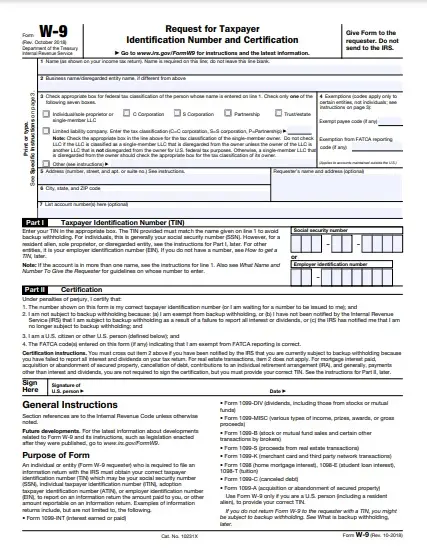

What is the W-9 form?

The W-9 form is an IRS form to provide the information needed by a person or company that will make payments to another person or company.

The company that pays you is responsible for requesting the W-9 form from you. However, the company requesting the W-9 has no obligation to file the W-9 with the IRS.

They keep the form handy and use that information to prepare other returns and also to help them to determine if federal tax withholding is required on the payments that you receive.

How does an ACH transfer work?

An automatic transfer (ACH) is an electronic transfer of funds from one account to another.

The amount of money is taken from the sending account and sent to an Automated Clearing House (ACH). Once the funds have been cleared by the sender's bank, the ACH then transfers the money to the receiver's account in the requested currency.

What information is required for an ACH transfer?

It is very simple to do an ACH transfer, you just need to provide the following details:

- Name

- Routing/ABA number

- Account number

- Whether the bank account is a business or personal account

- Transaction amount

How does a wire transfer work?

A wire transfer is an electronic transfer from one bank account to another. With the recipient's account number, you can offer a direct and fast deposit to the recipient. This eliminates the intermediary.

If both banks are located in the United States, this is known as a 'domestic wire transfer'. When one bank is outside the USA, this is referred to as an 'international wire transfer'.

What information is required for a wire transfer?

To do a wire transfer, you need the following information:

- Recipient full name

- Sender full name

- Recipient phone number

- Sender phone number

- Recipient address

- Recipient bank name and information

- Recipient checking account information